Summer Market Update

Low Demand Might Not Effect High Pricing

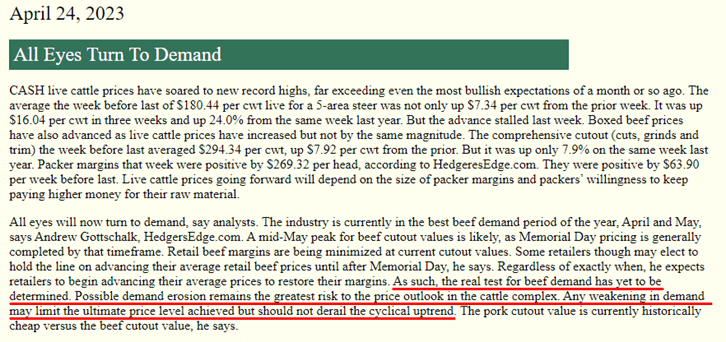

This is an interesting take on things – with pricing of beef having remained so high for the past two years, the possibility of “demand erosion” becomes a possibility. Basically, a slump in demand, which, theoretically, would result in a weakening price point. But one analyst believes even if we do see that happen, we will still see the typical upwards climb of pricing as we head towards the end of the year.

Remember that we always know to expect higher pricing during the 4th quarter, without fail, due primarily to the high demand for the holiday season.

Historical vs Now

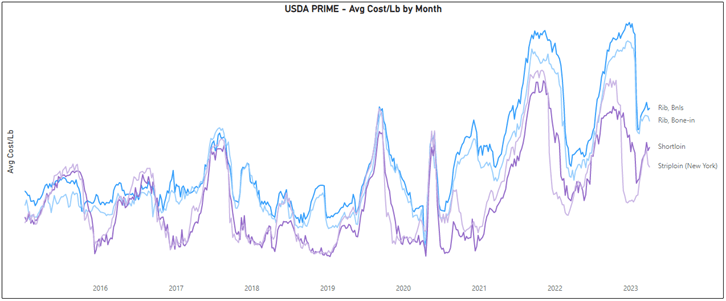

I have a love/hate relationship with looking backwards at where Prime Beef pricing has been, historically. Well, mostly hate. The last three years have seen some of the craziest swings in Prime pricing. The industry has always had seasonal cycles, but what used to be a swing of a few bucks has turned into swings of $4-$8. Because you lose both moisture and trim from the dry aging process, large swings in material cost result in significant increases/decreases in final product cost.

In terms of what we think the rest of the year will look like (because that’s what everyone wants to know), as always, it’s impossible to tell, but if we have to judge on the past, it’ll most likely follow the same trendline as we saw in 2021 and 2022. Somewhat steady through the end of summer, then Prime will begin to climb in Q4. Where 2023 might play out differently though is the ‘lull’ not lasting till the end of summer. On the graph above; pay attention to how much shorter of a ‘low’ period of pricing we experienced this year. Almost immediately after pricing fell at the beginning of the year, it began to climb back up. So, jury’s out if that means we’ll see a slow / steady climb to the same highs of last year Q4, or maybe we just chill at this awkward ‘still too high to enjoy it but not high enough to lose sleep over’ level.

There were a few other graphs I was going to put up here, but they were feeling kinda negative nancy (number of cattle on feed is down = bad news… percentage of cattle grading prime lowest in 3 years = bad news… graded beef headcount lowest in 4 years = bad news)… so realistically, I think it’ll be a tough year for Prime Beef, but hey, that means that there’s nowhere to go but up 🙂

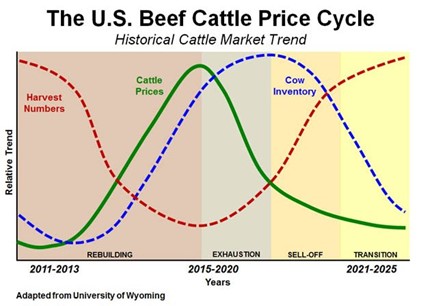

The Cattle Cycle

The cattle cycle is the approximately 10-year period in which the number of U.S. beef cattle is alternatively expanded and reduced over several years in response to changes in profitability by producers.

Like other commodity cycles, the pricing of cattle is linked directly to how much supply is available, and the demand for that supply. However, where it differs drastically from say, the crop cycle, is how long each cycle goes for. The combination of cattle having offspring one at a time, with the comparatively long gestation/maturation time (compared to other proteins), means that adjustments in the herd are slow to happen, and even slower to adjust.

The situation we are in right now is that the herd is the lowest it has been in years – a result of prolonged drought and high grain prices over the past few years. What that means is that in order to grow the herd, ranchers need to retain heifers (females), which will further restrict the number of animals available for slaughter. So as supplies continue to decline, we will see pricing increase.